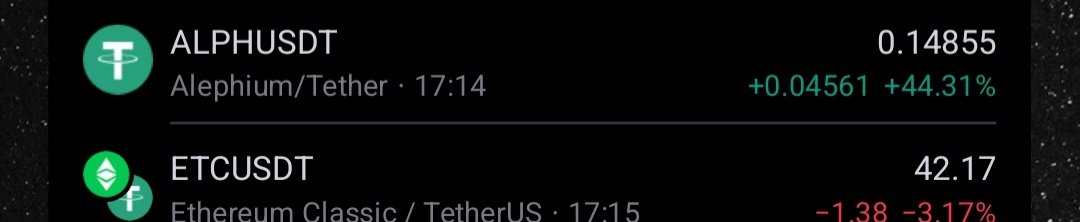

Nije naknadna pamet ako su do skoro takve cene bile nezamislive, nego čisto podsećanje da se na mnogo mesta čulo "oprezno, oprezno" itd. Moj reper je ath i koliko je neki coin pao u odnosu na ath. Bch je na primer sa cenom od 100$ bio na skoro 1/40 od svog ath i to mi je bilo prilicno sigurica za kupovinu. Etc na 14$ = 1/10 ath itd. Nisam neki ekspert, jer da jesam ne bih i dalje bio u minusu, ali sada polako peglam ono što sam naivno minusovao u periodu nultog znanjaTo se zove naknadna pamet. Samo pravi štetu, posebno u kriptu.

Koristite zastareli preglednik. Možda se neće pravilno prikazivati ova ili druge veb stranice.

Trebalo bi da nadogradite ili koristite alternativni preglednik.

Trebalo bi da nadogradite ili koristite alternativni preglednik.

Diskusija o cenama

- Status

- Zatvorena za pisanje odgovora.

Klapaucius

Cenjen

- Učlanjen(a)

- 12.12.2021

- Poruke

- 409

- Poena

- 115

Celsius je mrtav. Otpustili su skoro sve radnike u Beogradu a nista drugacije nije ni sa timovima u ostalim delovima sveta.

Nije pametno ulaziti u bilo kakve kalkulacije i trgovinu sa CEL tokenima. Velika kolicina CEL tokena je nedostupna ljudima koji ih poseduju, dakle manipulise se sa onim preostalim, dostupnim.

Nije pametno ulaziti u bilo kakve kalkulacije i trgovinu sa CEL tokenima. Velika kolicina CEL tokena je nedostupna ljudima koji ih poseduju, dakle manipulise se sa onim preostalim, dostupnim.

Nikola mJet

Slavan

- Učlanjen(a)

- 22.04.2018

- Poruke

- 2,441

- Poena

- 315

I vecite debata  kad pada cekaj pasce sigurno jos, a cim krene malo da se batrga onda ide prica ja sam kupovao postepeno ko vas sisa

kad pada cekaj pasce sigurno jos, a cim krene malo da se batrga onda ide prica ja sam kupovao postepeno ko vas sisa  bilo je price da btc ide na 8k, ja eth cekam na 650-700 pa kad dodje dodje. Kriza nije ni krenula, ovo je relax period da se navuku mladi igraci, naravno iskusni ce zaraditi, manje iskusni ici grlom u jagode. Polako, nece to nigde, Winter is coming.

bilo je price da btc ide na 8k, ja eth cekam na 650-700 pa kad dodje dodje. Kriza nije ni krenula, ovo je relax period da se navuku mladi igraci, naravno iskusni ce zaraditi, manje iskusni ici grlom u jagode. Polako, nece to nigde, Winter is coming.

- Učlanjen(a)

- 08.03.2003

- Poruke

- 6,785

- Poena

- 1,065

Moja oprema

- CPU & Cooler

- Ryzen 5 5600X

- Matična ploča

- Asus Prime B350-Plus

- RAM

- 16GB Corsair DDR4 CMK16GX4M2B3200C16

- GPU

- Sapphire Pure Radeon 9060 XT 16GB

- Storage

- XPG Gammix S11 Pro 1TB

- PSU

- Seasonic 520W 12Mii

- Monitor

- BenQ VZ2770 27"

- Miš & tastatura

- Motospeed Ck104, ProtoArc EM03

- Mobilni telefon

- Poco F5

- Pristup internetu

- Optički internet

Celsius je mrtav. Otpustili su skoro sve radnike u Beogradu a nista drugacije nije ni sa timovima u ostalim delovima sveta.

Nije pametno ulaziti u bilo kakve kalkulacije i trgovinu sa CEL tokenima. Velika kolicina CEL tokena je nedostupna ljudima koji ih poseduju, dakle manipulise se sa onim preostalim, dostupnim.

Što je još gore, Celsius je povukao dole i niz drugih kompanija i projekata, a prava ukupna šteta još uvek tek polako izlazi na površinu. Ove nedelje je Nuri (bivši Bitwala) objavio da je ostao bez novca za funkcionisanje, jer je bio izložen Celsiusu. Ja brže bolje potrčao da povučem pare, ali nisam ni morao, ovaj projekat je jedan od retkih potpuno poštenih u kripto svetu koji nije pokušao da prikrije insolventnost, a moj novac je bio sasvim siguran u nemačkoj Solaris banci, verovatno i sigurniji nego u grčkoj banci gde sam ga prebacio.

Kada jedan Celsius može ovoliko štete da napravi, šta tek ima da bude kada glavna kripto prevara Tether bude neizbežno pukla.

Borat Odorović

Slavan

- Učlanjen(a)

- 21.06.2021

- Poruke

- 561

- Poena

- 405

Gala najavljuje za kraj avgusta igricu Voking đed, u skorije vreme još desetak.

Pre par meseci osnovali Gala Film, već sad u najavi dokumentarac Four Down u saradnji sa Rokom i Seven Bucks Productions (odgovorni za nekoliko bulšit blokbastera, u dosta njih "glumi" Rok). Tu je i serijal kratkih filmova u koje umešan Snup Dog, muziku odatle objavljuje Gala Music. Uskoro i SF serija Razor sa premijerom na blokčejnu i crtać Ghosts of Ruin, to valjda po nekoj igrici koju već izbacili...

Jako miriši na jaku pumpu, nešto od toga ovde:

allnewspress.com

allnewspress.com

Pre par meseci osnovali Gala Film, već sad u najavi dokumentarac Four Down u saradnji sa Rokom i Seven Bucks Productions (odgovorni za nekoliko bulšit blokbastera, u dosta njih "glumi" Rok). Tu je i serijal kratkih filmova u koje umešan Snup Dog, muziku odatle objavljuje Gala Music. Uskoro i SF serija Razor sa premijerom na blokčejnu i crtać Ghosts of Ruin, to valjda po nekoj igrici koju već izbacili...

Jako miriši na jaku pumpu, nešto od toga ovde:

The latest news from the world

Découvrez les dernières actualités en France et dans le monde. Suivez l'actualité en temps réel avec notre site d'informations

Detector

Slavan

- Učlanjen(a)

- 01.11.2013

- Poruke

- 1,256

- Poena

- 305

Ja da sam imao vise para sigurni bi stavio u celsius jedan deo..Bilo je lepo dok je trajalo. Ja sam sve što sam imao povukao sa Celsiusa dan nakon što je pukla LUNA. Nešto lepo i od tog događaja da mi ostane u sećanju. Ne ulažite ništa u Celsius, gotov je.

Cak sam pricao ovde da mi to deluje kao dobra opcija, sad bolje da se pokrijem usima.

Tref

Cenjen

- Učlanjen(a)

- 23.03.2013

- Poruke

- 447

- Poena

- 195

Da hoće bar na 150 uskoro. Ulazna mi je preko 100 još od marta, ma da sam vreć u aprilu imao 30% i ne uzehLTC ne verujem da ce preci 250 opet.

Skankhunt42

Slavan

- Učlanjen(a)

- 14.11.2016

- Poruke

- 2,880

- Poena

- 235

svi predvidjaju dno u novembru, a ja tad imam milion troskova, kupujem auto, telefon, konzole, cuda... sto ga ne naciljaju nekad kad imam pare....

vlayza

Čuven

- Učlanjen(a)

- 07.11.2007

- Poruke

- 2,511

- Poena

- 565

Ja sam relativno nov (od 2018. godine sam u kriptu). Ono što sam primetio za ove 4 godine, što čitajući poruke pametnih ljudi, što na sopstvenom iskustvu: Za long trenutrno samo BTC i ETH. Altcoine kupovati samo kada dotaknemo dno bear marketa, kada krene bull i ono najbitnije, ne kupovati altove iz prethodnog ciklusa.

Verujem da će još neko pomoći i dodati neki komentar.

Verujem da će još neko pomoći i dodati neki komentar.

[SAJ]ber Kurajber

Uticajan

- Učlanjen(a)

- 17.04.2004

- Poruke

- 20,131

- Poena

- 1,585

Moja oprema

- CPU & Cooler

- Ryzen 5700X3D & Noctua NH-D15

- Matična ploča

- Asrock x370 killer SLI

- RAM

- 32GB G-Skill Trident Z 3200 CL14

- GPU

- Asus Strix 1080TI

- PSU

- Seasonic 760XP2

- Kućište

- Corsair 600T

- Miš & tastatura

- Logitech G15 $ MX518

- Mobilni telefon

- Xiaomi 14T

- Pristup internetu

- Kablovski internet

Svrbi ga

Kad krene da svrbi mora da se cese.

Kad krene da svrbi mora da se cese.

Nikola mJet

Slavan

- Učlanjen(a)

- 22.04.2018

- Poruke

- 2,441

- Poena

- 315

Zato sto ce ga kupiti na 650$ kao i ja  haha

haha

- Učlanjen(a)

- 03.07.2000

- Poruke

- 9,836

- Poena

- 985

China Shocks With Rate Cut as Data Shows ‘Alarming’ Slowdown

China’s economic slowdown deepened in July due to a worsening property slump and continued coronavirus lockdowns, with an unexpected cut in interest rates unlikely to turn things around while those twin drags remain.

China’s central bank cut both one-year and seven-day lending rates by 10 basis points, a move economists said would have little impact since Covid controls have made households and businesses reluctant to borrow. New credit in July increased at the slowest pace since at least 2017.

“The rate cut shows the entire economy is in trouble,” said Iris Pang of ING Groep NV. A wave of mortgage boycotts by households over incomplete projects has made households nervous about buying homes, reducing the impact of lower mortgage rates, she added.

mmarkomarko

Slavan

- Učlanjen(a)

- 21.08.2013

- Poruke

- 141

- Poena

- 215

Sad se pumpa ETH pred merge. Ista prica kao i prvi fjucersi za BTC, pumpanje LTC pred halving i pumpanje Dodge pred ono pojavljivanje EM u onoj nekoj emisiji...

Vec vidjen scenario 100x. Balon uvek pukne pre najavljenog dogadjaja i onda krece istresanje. Gospodin sa 150.000 ETH to ocigledno zna...

Vec vidjen scenario 100x. Balon uvek pukne pre najavljenog dogadjaja i onda krece istresanje. Gospodin sa 150.000 ETH to ocigledno zna...

- Status

- Zatvorena za pisanje odgovora.

Preporučite:

Instalacija aplikacije

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Napomena: this_feature_currently_requires_accessing_site_using_safari